Making investing accessible to all

FINQ platform may reference third-party trademarks, which are owned by their respective owners. Such references are for informational purposes only and do not imply any affiliation, sponsorship, endorsement, or authorization by those third parties.

FINQ platform may reference third-party trademarks, which are owned by their respective owners. Such references are for informational purposes only and do not imply any affiliation, sponsorship, endorsement, or authorization by those third parties.Who we are

FINQ is an AI-driven fund manager applying a proprietary, adaptive AI framework to investment products. Our goal is to make data-driven investment solutions accessible to a wide range of investors and professionals.

Our mission

FINQ empowers individuals to achieve their financial goals through intelligent, personalized, and accessible wealth management, harnessing the power of AI to deliver elite investment strategies previously served for the few.

Our founders

Founded by seasoned investor Eldad Tamir and backed by cybersecurity pioneer Nir Zuk, FINQ combines deep capital markets expertise with advanced technology to serve both individuals and institutions.

Our global presence

FINQ operates through distinct legal and regulated entities in the United States and Israel.

In the United States, FINQ is an SEC-registered investment adviser and serves as the sub-adviser to FINQ’s actively managed ETFs.

In Israel, FINQ Israel operates independently across the investment and pension ecosystem. Its activities include managing a mutual fund, providing AI-driven investment portfolio management, and offering digital pension agency services — all conducted under Israeli regulation and supervision.

Hear from our founder

Eldad Tamir, founder and CEO of FINQ, shares the vision behind FINQ’s actively-managed ETFs and explains how they are managed by a proprietary, adaptive AI framework that continuously ranks all 500 S&P 500® stocks. Learn how FINQ is applying technology to bring data-driven investment solutions to a wide range of investors.

The video discusses forward-looking strategy design. Investment

results are not guaranteed, and all ETFs involve risk.

Why it matters

The problem

Many investors face a choice between index-tracking

funds that provide broad exposure but do not adapt, and

traditional active strategies that rely on subjective

decision-making and may be difficult to access.

The solution

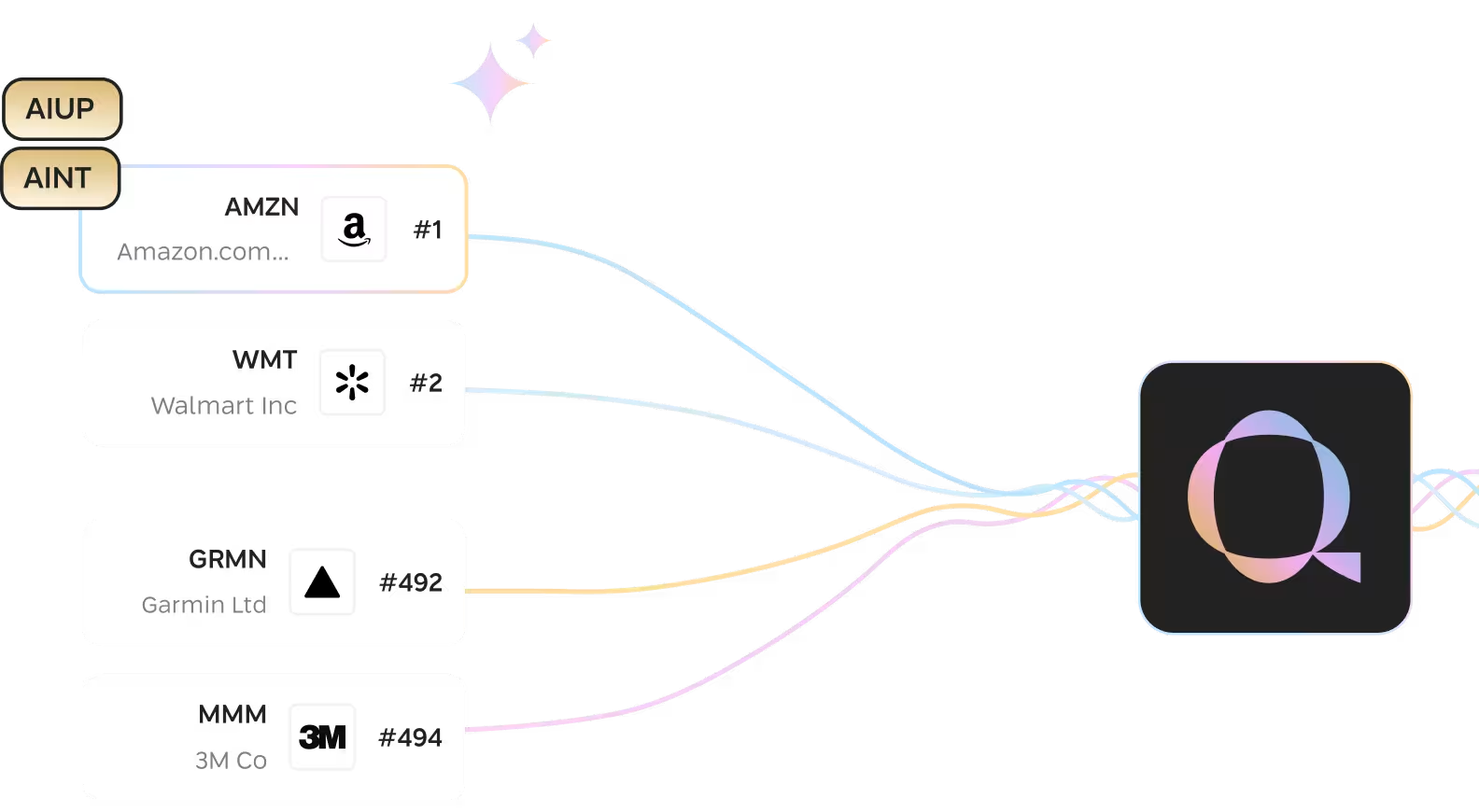

FINQ applies a proprietary, adaptive AI framework that

systematically analyzes and ranks all 500 stocks in the S&P

500® Index each day. These model-generated rankings

guide portfolio construction in FINQ's actively-managed

ETFs. While all investing involves risk and results are not

guaranteed, this framework provides a structured, data-

driven approach to U.S. large cap equity investing.

FINQ platform may reference third-party trademarks, which are owned by their respective owners. Such references are for informational purposes only and do not imply any affiliation, sponsorship, endorsement, or authorization by those third parties.

FINQ platform may reference third-party trademarks, which are owned by their respective owners. Such references are for informational purposes only and do not imply any affiliation, sponsorship, endorsement, or authorization by those third parties.Get your questions answered

Can't find the answer here? Contact us